Real Sender For Mt103 Swift Transfer 2023

How to Get Real Sender For Mt103 Swift Transfer 2023

Tags : Real Sender For Mt103 Swift Transfer ,MT103 , SBLC, GPI, DTC, TT, Mt103/202 ,MT103 Wire TRANSFER, GPI AUTO, Bank To Bank, bank instrument, Ipip , SEPA,KTT, IPIP/DTC, MT103/202 DIRECT WIRE TRANSFER,IPIP/DTC , SEPA TRANSFER , Oil daily Google Group, SLBC PROVIDER, IBAN TO IBAN TRANSFER ,S2S Private Server Ip Deal , Real Sender, Real Receiver, Real Provider, MT103, sblc, BG, MT199, MT799, TT wire transfer, Swift wire transfer, Company checks,

MT103 procedure , MT103 non-kyc , MT103 kyc, Mt103 2023, BOA MT103, JP Morgan Chase MT103 , Truist MT103, HSBC MT103, DB Germany MT103,VP Bank MT103,MT103/202 CASH TRANSFER ,FLASH ,WIRE TRANSFER, DIRECT DEPOSIT ,MOBILE TRANSFER , PAYPAL BITCOIN FLASHING , POS ONLINE .

If you are a receiver and you are looking for page , forum, community or website online where you can get a Real Sender For Mt103 Swift Transfer , this is the right place.

Real Sender For Mt103 Swift Transfer – It seems these days, alot of people are focusing on getting an MT103/202 swift transfer. However, it seems many people out of desperation , are getting scammed , especially in many free forum websites on the internet . Some of these places include; Oildaily google group, o9c4 , WorldOfFunds, Facebook groups, Linkedin Groups, Discord Groups, Reddit Groups, etc.

Real Sender For Mt103 Swift Transfer : What is MT103 ?

According to Flywire , It is a detailed document that is generated when you complete an international transfer at your bank, acting as a confirmation of payment made from your bank and informs the beneficiary of all the details of the transaction, including any fees applied.

Credit : Flywire

Below are the fields of an MT103 message. These fields are referred to as tags.

Tag | Name |

20 | Transaction reference number (sender’s reference) |

13C | Time Indication |

23B | Bank operation code |

23E | Instruction Code |

26T | Transaction Type Code |

32A | Value date / currency / interbank settled amount |

33B | Currency / original instructed amount |

36 | Exchange Rate |

50A, F or K | Ordering customer (payer) or address of the remitter. |

51A | Sending Institution |

52A or D | Ordering Institution (payer’s bank) |

53A, B or D | Sender’s Correspondent (bank) |

54A, B or D | Receiver’s Correspondent (bank) |

55A, B or D | Third Reimbursement Institution (bank) |

56A, C or D | Intermediary Institution (bank) |

57A, B, C or D | Account With Institution (beneficiary’s bank) |

59 or 59A | Beneficiary Customer 4×35 |

70 | Remittance Information |

71A | Details of charges (OUR/SHA/BEN) |

71F | Sender’s Charges |

71G | Receiver’s Charges |

72 | Sender to receiver information |

77B | Regulatory reporting |

Credit : Wikipedia

An MT103 is a standardized SWIFT payment message used specifically for cross border/international wire transfers.

MT103s are globally accepted as proofs of payment and include all payment details such as date, amount, currency, sender and recipient.

MT103s are also great for tracing payments which are missing or delayed because they show the route of the payment between the banks.

All banks and financial institutions which make payments via SWIFT will have an MT103 for every payment, but they are unlikely to let you have them.

As the world continues to become more globalized and international transactions have become part of daily business, banks and financial institutions have had to adapt.

One of the ways they have achieved this is through SWIFT payments.

In order to understand MT103 documents, you first have to understand what a SWIFT payment is.

SWIFT is an acronym for Society for Worldwide Interbank Financial Telecommunications system.

The SWIFT system is used for international payment transfers.

There are over 11,000 members in the SWIFT network, and it’s reported that in 2020 there were over 35 million transactions per day.

Additionally, year over year, the data is already showing almost a 10% growth in transactions in 2021.

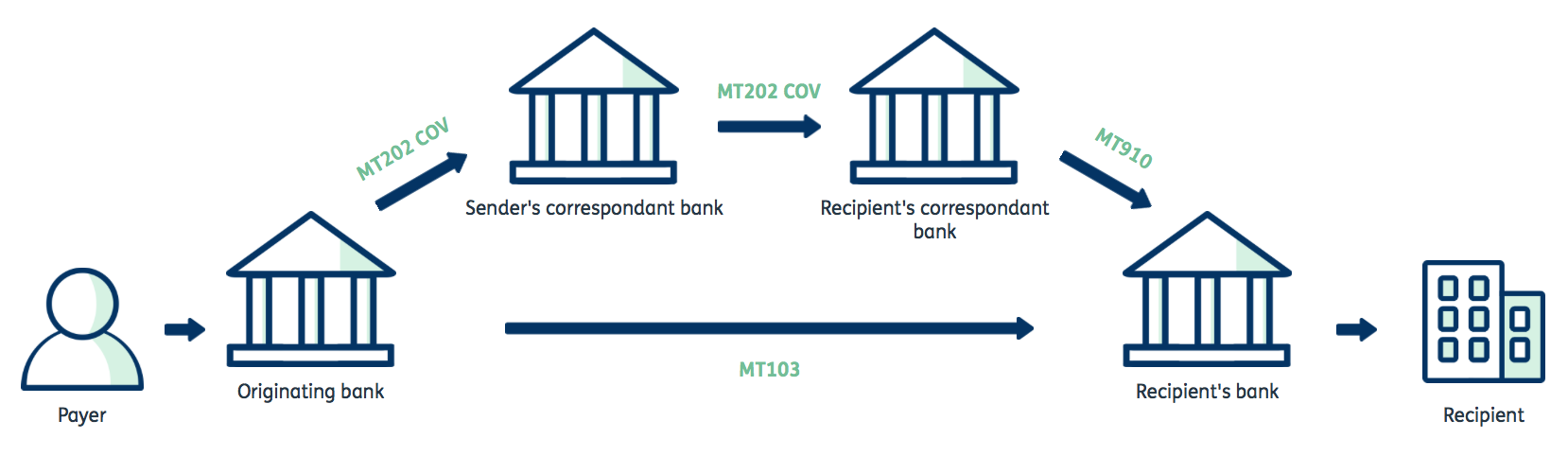

How Do SWIFT Payments Work?

In order for a SWIFT payment order to be issued, the system uses what is called a SWIFT code.

The SWIFT network actually standardized the formats for BIC (bank identifier codes) and IBAN (international bank account numbers).

Because SWIFT owns the BIC system, it can identify a bank in merely a few seconds.

SWIFT codes are 8 to 11 characters and are unique to each bank.

The code will have the following:

Institute code

Country code

Location or city code

Individual branch code – these are technically optional, but most institutions use them

The process of sending a SWIFT transaction is very simple while still being one of the most secure ways to transfer money internationally.

You simply need the account number and the branch’s specific SWIFT code in order to set one up.

The SWIFT system is essentially a communication platform.

Banks can enclose payment instructions, but they can also process security requests and other varying system transactions.

About 50% of the messages that come from SWIFT are still for payments and 47% come from security transactions.

The rest are trade, treasury, and system notifications.

All banks that work within the network use Nostro and Vostro accounts to carry out the payment transfer.

These accounts are used as a way to record the movement of the money and are a mirrored ledger of each other.

Nostro accounts are where the bank holds the money and Vostro accounts are the ones used for opening it in the bank’s books.

If both banks involved in the transaction use Nostro and Vostro accounts, the SWIFT payment that was initiated will happen instantly.

If these accounts aren’t involved on both sides, the SWIFT transaction could have to go through a third party or another intermediary account.

A typical SWIFT transaction takes about 2-5 business days to be completed.

SWIFT was created in 1973 to replace Telex which was the only form of message confirmation for an international funds transfer.

Telex confirmations were slow, weren’t secure, and had issues with communication between banks.

The unified system of codes that were created for SWIFT has been revolutionary for the future of transfer communication.

SWIFT payments are extremely versatile.

They can be used for many different financial entities.

Some examples are:

Treasury Market Participants

Banks

Clearing Houses

Corporate Business Houses

Depositories

Brokerage Institutes and Trading Houses

Exchanges

What is an MT103 Document and How Does It Work?

The MT103 is a SWIFT payment message that is used for international wire transfers specifically.

Here’s what it looks like:

These messages are standardized so that they’re easy to read and understand.

MT103 messages are proof of payment in case something goes awry.

They include all of the important details such as the sender, the recipient, the amount, and the date.

Consumers and financial institutions can also use the MT103 as a way to track the payment while it’s en route.

This is especially helpful when the payment needs to go through intermediary banks and isn’t done instantly via Nostro and Vostro accounts.

One of the main reasons SWIFT has been dominant in the market is because of the MT103 messages.

They are detailed and are accepted as proof of payment.

This is another reason the transactions are so secure.

SWIFT messages are created manually which is about the only hindrance in the process.

There is a need for automation in the process, but that requires additional resources that the program currently doesn’t have.

SWIFT makes money through one-time membership fees, charges based on the length of the message being sent, and charges depending on how high a certain bank’s volume of transactions is.

In a world where every day the consumer wants instantaneous money transfers, SWIFT will continue to adapt and create a user-friendly and easy experience for all involved.

The only way to stay relevant in a world where there is constant change, is to constantly adapt.

With new payment platforms being developed daily, SWIFT will have to continue to be the pinnacle of security and ease.

FAQs

How Do SWIFT Payments Work?

The SWIFT network actually standardized the formats for BIC (bank identifier codes) and IBAN (international bank account numbers).

What are SWIFT codes?

SWIFT codes are 8 to 11 characters and are unique to each bank.

What does the SWIFT code consist of?

Institute code, country code, location or city code and Individual branch code.

Benefits of MT103s

Having direct access to MT103s for each of your payments gives you greater control and information.

Confirmation

Evidence

Tracking

You have confirmation that your payment has been sent, including all the important details such as recipient information and payment amount.

Serves as a valid proof of payment, whether to send to a supplier to serve as proof of payment or to accounts payable for reconciliation purposes.

An MT103 can help with payment location and tracking if the funds are held up in regional clearing banks on the way to your recipient.

Real Sender For Mt103 Swift Transfer 2023 FROM Trojanvilla

Note : As you know. This website is a lau*dering website and is run and managed by expert hackers and IT specialists , most of whom have worked in major banks globally.

Our MT103 and other instruments is non-kyc . This is because most of the bank accounts from which we send money are dormant accounts belonging to deceased people who have no relative to claim them .

However, our assurance is that after sending out funds to receiver accounts and the money is cashed out, we wipe out the entire server . There is no trace or call back of any fund sent .

We don’t take ratio / percentage. Our only profit is the fee which you pay to us before this deal is done to the account which you will provide.

Our fees are fixed depending on the amount of money you want us to send through MT103 to you.

All fees are paid through bitcoin .

See below table of fee schedule for all MT103 transactions.

TROJANVILLA MT103 FEE SCHEDULE

FACE VALUE (USD)

FEE (USD)

PAYMENT LINK

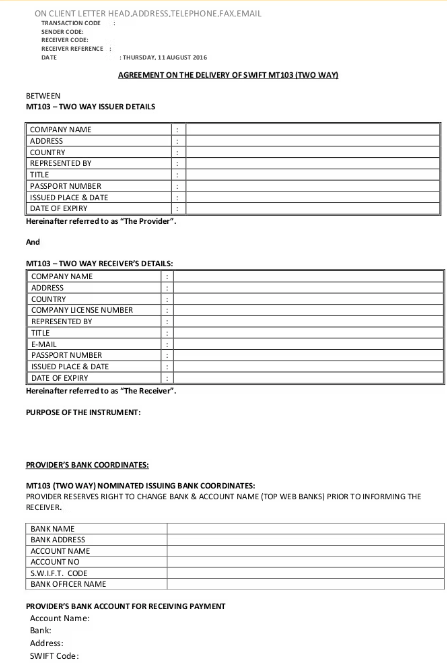

SUMMARIZED PROCEDURE

- Make payment by selecting one of the options applicable to you able

- We send you a payment confirmation email

- You send us details required to execute the Mt103 job. This will be contained in the confirmation email we will send you

- Allow us 5 Hours to execute the job.

- We send you the swift copy of the MT103 wire confirmation slip and black screen screenshots to the email you provided

- Money becomes available in your bank account within 12 hours.

- Repeat process if you wish to go on second tranche .

NOTE: After 24 hours and the money has not been credited to your bank account, contact us through our live chat support ,

Although it is impossible to have a delay as we use the best servers to give our clients the best.

For more details on this, kindly use our 24/7 live chat support.

Trojanvilla